How Offshore Trusts Fit into a Global Tax Optimization Plan

Why You Need To Take Into Consideration an Offshore Depend On for Safeguarding Your Possessions and Future Generations

If you're wanting to shield your riches and ensure it lasts for future generations, taking into consideration an overseas depend on could be a smart action. These counts on offer special advantages, such as improved possession protection and tax performance, while additionally preserving your personal privacy. As you check out the potential of offshore trust funds, you'll discover how they can be tailored to fit your particular needs and objectives. Yet exactly what makes them so appealing?

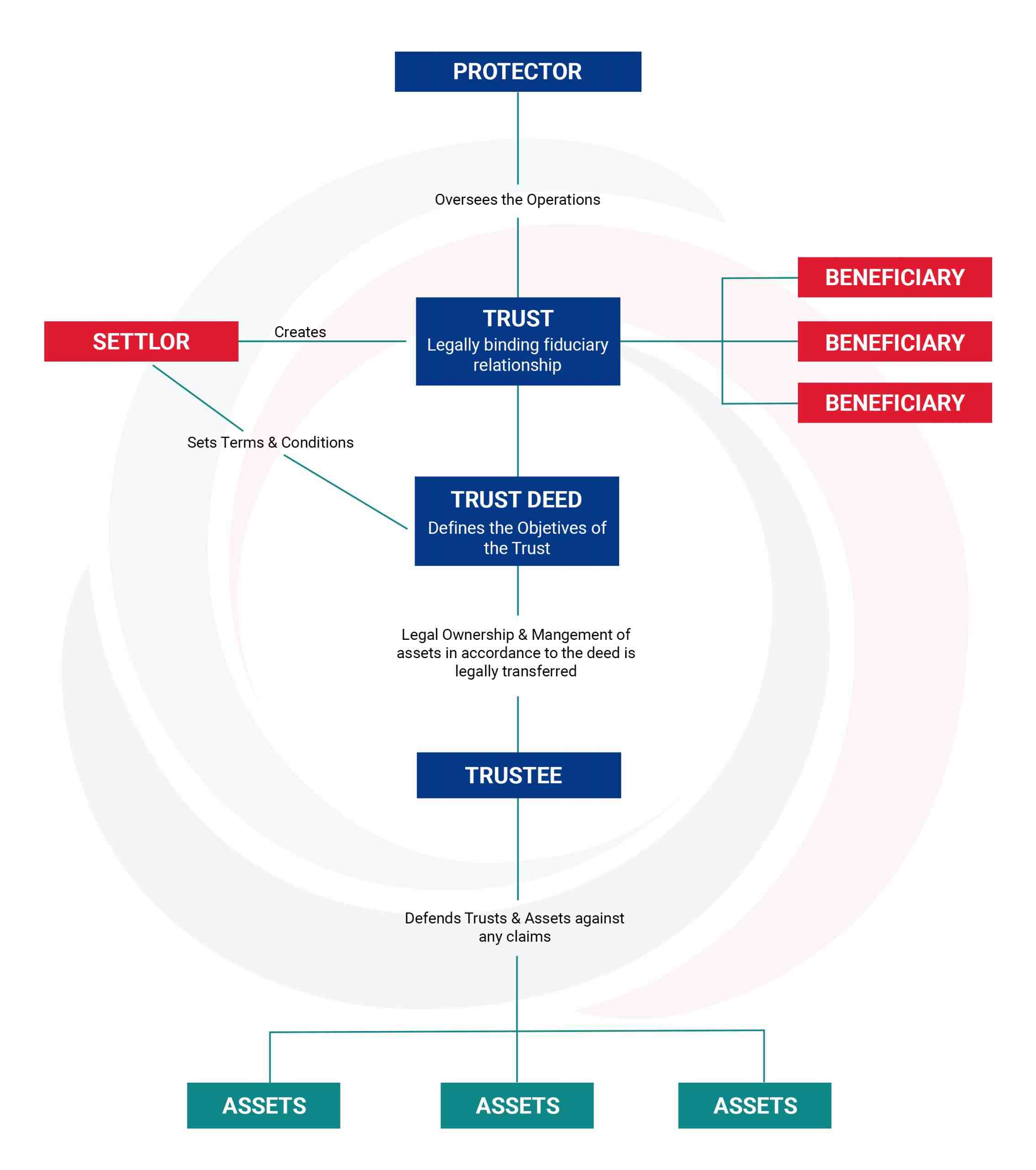

Comprehending Offshore Trusts: What They Are and Just How They Function

When you assume about protecting your possessions, offshore trusts might enter your mind as a feasible choice. An offshore trust is a lawful plan where you move your assets to a trustee located in another country. This trustee manages those possessions in behalf of the recipients you mark. You maintain some control over the depend on, but the lawful possession changes to the trustee, using protection from potential creditors and lawful claims.

The key parts of an offshore trust fund consist of the settlor (you), the trustee, and the beneficiaries. Recognizing how offshore depends on function is crucial before you make a decision whether they're the ideal choice for your possession protection method.

Advantages of Establishing an Offshore Trust Fund

Why should you take into consideration establishing an offshore trust? One of the key benefits is tax obligation performance. By putting your properties in a jurisdiction with positive tax obligation laws, you can possibly lower your tax problem while guaranteeing your wealth expands. Additionally, offshore depends on offer versatility pertaining to asset administration. You can customize the trust to fulfill your specific demands, whether that's preserving control over your assets or ensuring they're distributed according to your desires.

Offshore trust funds can give a greater degree of privacy, protecting your monetary affairs from public examination. Establishing an offshore trust can advertise generational wide range preservation. Ultimately, an offshore trust can offer as a critical device for protecting your monetary legacy.

Protecting Your Properties From Lawful Cases and Financial Institutions

Developing an overseas depend on not only offers tax obligation advantages and personal privacy yet additionally works as an effective guard against lawful cases and lenders. When you position your possessions in an offshore depend on, they're no more taken into consideration component of your personal estate, making it a lot harder for creditors to access them. This splitting up can secure your wealth from suits and insurance claims occurring from organization disputes or personal obligations.

With the best territory, your assets can gain from rigorous privacy laws that prevent lenders from pursuing your riches. Furthermore, numerous offshore depends on are designed to be challenging to penetrate, typically requiring court activity in the count on's jurisdiction, which can serve as a deterrent.

Tax Effectiveness: Minimizing Tax Obligation Liabilities With Offshore Trusts

In addition, considering that trusts are often strained differently than individuals, you can gain from lower tax obligation prices. It's crucial, however, to structure your depend on effectively to guarantee conformity with both domestic and global tax legislations. Collaborating with a qualified tax consultant can help you navigate these intricacies.

Guaranteeing Privacy and Privacy for Your Wide Range

When it concerns shielding your wide range, assuring personal privacy and confidentiality is necessary in today's progressively clear economic landscape. An overseas trust can supply a layer of security that's difficult to attain via residential alternatives. By putting your assets in an overseas jurisdiction, you protect your economic information from public examination and reduce the threat of unwanted attention.

These trust funds typically include stringent privacy legislations that prevent unauthorized access to your economic information. This means you can guard your riches while maintaining your satisfaction. You'll also limit the possibility of legal conflicts, as the details of your trust fund continue to be private.

Additionally, having an offshore trust suggests your assets are image source less susceptible to individual liability insurance claims or unanticipated monetary crises. It's a proactive action you can take to ensure your monetary tradition remains undamaged and personal for future generations. Count on an overseas framework to protect your riches successfully.

Control Over Property Distribution and Management

Control over possession distribution and monitoring is just one of the key benefits of setting up an offshore count on. By establishing this trust fund, you can dictate just how and when your possessions are dispersed to recipients. You're not simply handing over your wide range; you're establishing terms that mirror your vision for your legacy.

You can develop particular problems for circulations, ensuring that beneficiaries fulfill certain criteria prior to receiving their share. This control aids prevent mismanagement and warranties your assets are used in methods you consider appropriate.

Furthermore, appointing a trustee enables you to pass on administration obligations while keeping oversight. You can choose somebody who aligns with your values and comprehends your goals, assuring your properties are managed carefully.

With an overseas trust fund, you're not just protecting your riches but also shaping the future of your beneficiaries, providing them with the support they require while maintaining your wanted level of control.

Picking the Right Territory for Your Offshore Count On

Search for countries with solid legal frameworks that sustain trust fund legislations, making certain that your assets stay protected from next potential future insurance claims. Furthermore, availability to local economic institutions and skilled trustees can make a huge difference in managing your trust fund efficiently.

It's necessary to evaluate the prices included also; some territories may have higher setup or upkeep costs. Eventually, choosing the appropriate jurisdiction implies straightening your financial goals and family members requires with the certain benefits provided by that area - Offshore Trusts. Take your time to study and consult with professionals to make the most informed choice

Regularly Asked Questions

What Are the Prices Related To Establishing up an Offshore Count On?

Establishing an overseas trust fund includes different expenses, consisting of legal costs, configuration fees, and recurring maintenance expenses. You'll want to allocate these variables to assure your trust operates efficiently and effectively.

Exactly How Can I Discover a Reliable Offshore Trust Fund Service Provider?

To discover a trusted offshore depend on company, research study online testimonials, ask for recommendations, and validate qualifications. Ensure they're knowledgeable and clear concerning fees, solutions, and guidelines. Count on your instincts throughout the choice procedure.

Can I Handle My Offshore Count On From Another Location?

Yes, you can manage your offshore depend on remotely. Several service providers offer on the internet access, permitting you to keep track of financial investments, interact with trustees, and accessibility papers from anywhere. Simply ensure you have safe and secure web accessibility to safeguard your information.

What Occurs if I Move to a Various Country?

If you relocate to a various country, your overseas depend on's regulations may transform. You'll need to seek advice from with your trustee and potentially readjust your trust's terms to abide with local regulations and tax effects.

Are Offshore Trusts Legal for People of All Countries?

Yes, overseas depends on are legal for people of numerous countries, however guidelines differ. It's important to research your nation's laws and consult a lawful professional to guarantee compliance and understand potential tax obligation implications More Info before proceeding.